Determining Planting Density

Determining Planting Density

APRIL 15, 2024 ECONOMICS, PLANTING

As growers grapple with planting new blocks in the HLB era, there has been considerable discussion about planting densities to optimize growth and yield. John Chater, assistant professor of horticultural sciences with the University of Florida Institute of Food and Agricultural Sciences (UF/IFAS), has been working with growers in evaluating new varieties and rootstocks as trees are planted.

TRENDING HIGHER

He says most growers are trending toward higher densities when compared to the historical standard. But he adds the trend toward pushing densities higher has plateaued for now.

“There must be a sweet spot for density when considering cultivar selection, site conditions and cultural practices,” Chater says. “With HLB, there are often less fruit per tree, so it perhaps makes sense to have more trees per acre to maximize production. The nutrient requirements of plantings with higher densities need to be worked out, as do the water factors. How planting more trees per acre affects drought conditions (considering tree stress) and nutrient uptake in the field can be important factors to consider.”

However, one factor that could push tree densities much higher would be planting super-high-density groves to set them up for mechanical harvest. There are a few experimental groves in the state that are testing this concept; learn more.

ECONOMICS OF DENSITY

A UF/IFAS study in 2022 evaluated three planting densities and their economics. The study compared 145 trees per acre (25 x 12 feet), which is a historical average, to 220 trees (22 x 9 feet) and 303 trees (18 x 8 feet) per acre. The study considered cost factors like irrigation, frost protection, fertilization and other production expenses. And the study assumed that the lifespan of groves has been reduced from 30 years to 20 years due to HLB.

When factors were considered and tabulated, the study found that the statewide average density of 145 trees per acre was not profitable under current market conditions. Despite the higher upfront level of investment required for planting 220 and 303 trees per acre, the study showed that under the assumptions and scenarios analyzed, those investments yield positive returns.

The study found that while in a higher-density grove trees produce somewhat less yield compared to trees in a lower-density grove. The higher number of trees contributes to a higher yield per acre. Therefore, planting higher-density groves could help offset some of the impact of HLB by decreasing the cost of production per box due to costs being allocated to a higher number of boxes. This ultimately results in an increase in profitability per acre.

The study’s authors noted limitations of their analysis: “First, because HLB was first found in Florida in 2005, it is not yet clear how trees will be affected by the disease in the future. Therefore, in our model, the impact of HLB on yield of trees that are 13 years old and older is a projection based on current data. Second, we did not include any potential impact of weather events such as freezes or hurricanes (and their effect on prices and yield) in our analysis. Third, potential future management strategies or solutions to HLB could involve planting (new) trees with resistant or tolerant traits to the disease, which could make an existing grove with trees that do not have such traits obsolete.”

According to Chater, most growers have taken the economics of higher density to heart.

“More than 200 trees per acre seems to be the more common number for growers putting in new blocks most recently,” he concludes.

Read the full economic study here.

The CRAFT program is responsible for nearly 10,000 acres of citrus plantings, including new blocks and resets. Since its founding in 2019, the

The CRAFT program is responsible for nearly 10,000 acres of citrus plantings, including new blocks and resets. Since its founding in 2019, the

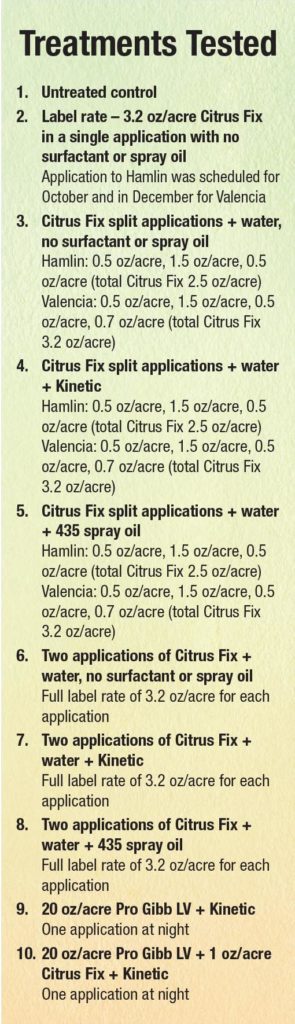

Using the plant growth regulators (PGRs) cytokinin in spring, gibberellic acid (GA) in summer and 2,4-D in late fall can be helpful for HLB-affected trees, horticulturist Tripti Vashisth reported. Her PGR update came during a Feb. 21 OJ Break. Multi-county citrus Extension agent Chris Oswalt hosted the event at the

Using the plant growth regulators (PGRs) cytokinin in spring, gibberellic acid (GA) in summer and 2,4-D in late fall can be helpful for HLB-affected trees, horticulturist Tripti Vashisth reported. Her PGR update came during a Feb. 21 OJ Break. Multi-county citrus Extension agent Chris Oswalt hosted the event at the

By Brandon Page

By Brandon Page

There’s a lot going on in Florida citrus. New trunk-injection therapies have been approved to treat HLB as groves bounce back from last year’s hurricanes.

There’s a lot going on in Florida citrus. New trunk-injection therapies have been approved to treat HLB as groves bounce back from last year’s hurricanes.